Fraudulent use of credit card – South Korea

While staying at a local hotel in South Korea, this client used someone else’s credit card without permission to purchase goods. Consequently, he was placed under investigation for fraud and violating Korea’s Specialized Credit Finance Business Act. The client immediately admitted that he had in fact violated the act, the person whose credit card he had used without permission refused to accept our client’s apology.

After being retained for legal services, the experts at Pureum Law Office (PLO) took active measures to further convey the client’s apology to the victim of credit card fraud, and did its best to make an amicable settlement between our client and the victim. In the end, it become possible for our client to make a reasonable monetary settlement with the victim.

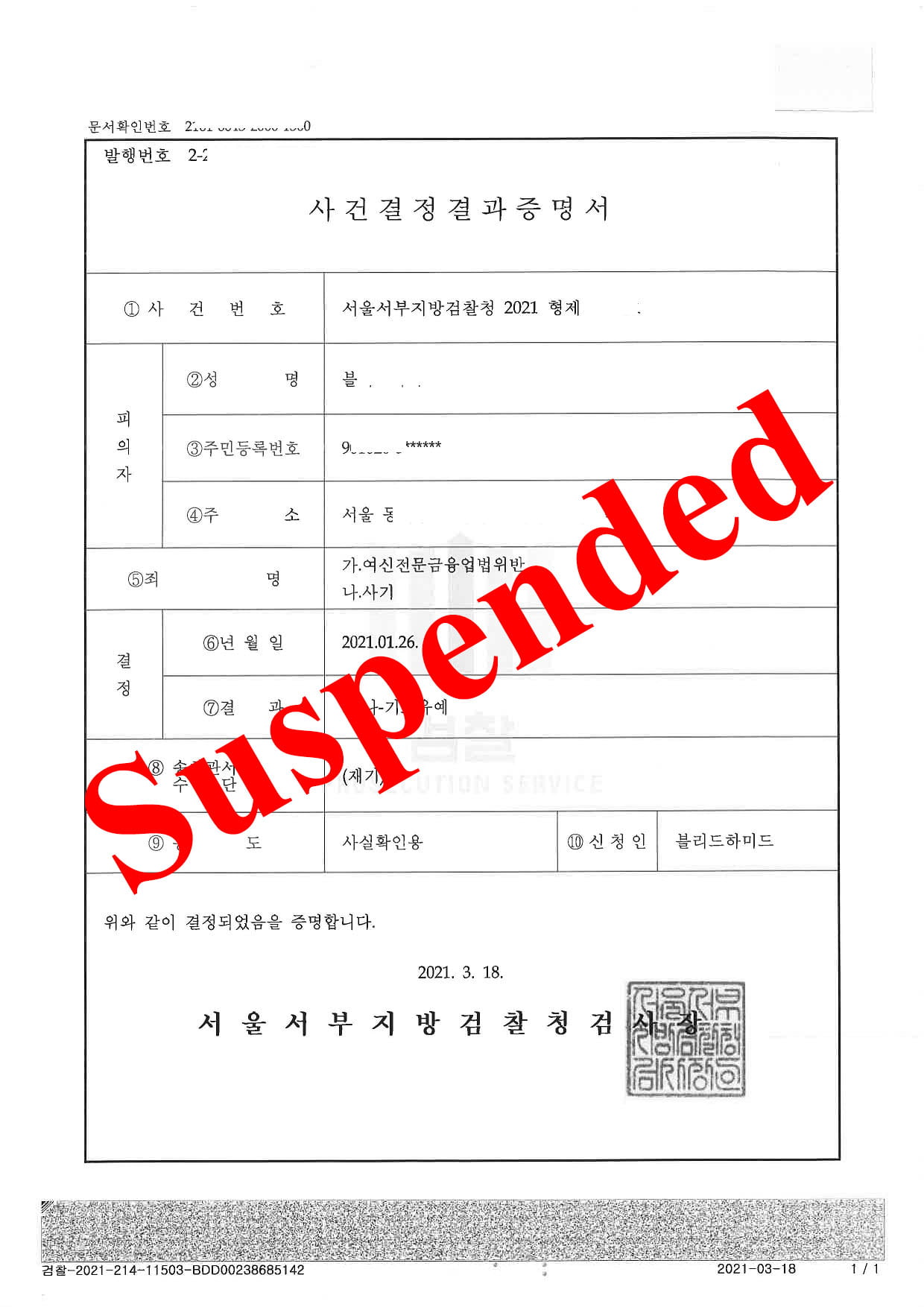

As a result of our legal expertise and efforts, PLO’s client was able to receive a suspension of the indictment and still resides in South Korea. However, had our client received a court order to pay a fine, etc., due to the crime he had committed by using someone else’s credit card without permission, we believe he would have seen a very high chance of being deported.

Thank you for reading this post on Fraudulent use of credit card – South Korea, be sure to see our other blog posts and pages for more legal advice and tips for foreigners and expats living in the ROK.

10 Things to do With Your Credit Card

- Sign your own autograph on the back on your new card as soon as you receive it. The card issuer cannot be liable for the victim who lost the card even for

the card fraud by a third party. - Write down the essential information (card number and card issuer’s phone number) separately.

- Avoid the use of a password as certificate of residence number, telephone number, license plate number.

- Use your card only for yourself. Lending card to others is like lending cash to them as an upper limit of the card.

- Used for the card other than specified purposes may make you listed as a credit delinquent. Lending loan using cards may crucial to affect your credit rating adversely.

- In calculating, present the card in person and must confirm sales receipts.

- Keep your password safely. In case of an cash advance service accident by password leaked, you cannot be compensated even if your card is lost/stolen. Keep your password safely.

- Avoid the long-overdue. Note that unusual and long overdue credit may affect you to be designated as a delinquent borrower.

- Contact your card issuer for the customer requisition when your bill does not arrive at the settlement date.

- Sales slip receipt (for members) must be kept until the bills on the card arrived and check the the bills and use is as proof if there are significant differences in the bills.